Why Did Service Providers Stop Subsidizing Phones?

A subsidy or government incentive is a course of financial aid or support extended to an economical sector (business organization, or individual) by and large with the aim of promoting economic and social policy.[i] Although commonly extended from the regime, the term subsidy can relate to any type of support – for instance from NGOs or as implicit subsidies. Subsidies come up in various forms including: straight (cash grants, interest-free loans) and indirect (taxation breaks, insurance, depression-involvement loans, accelerated depreciation, rent rebates).[2] [iii]

Furthermore, they can be broad or narrow, legal or illegal, ethical or unethical. The well-nigh mutual forms of subsidies are those to the producer or the consumer. Producer/product subsidies ensure producers are better off by either supplying market price support, direct support, or payments to factors of production.[3] Consumer/consumption subsidies commonly reduce the price of appurtenances and services to the consumer. For instance, in the US at i time it was cheaper to buy gasoline than bottled water.[i]

Types [edit]

Production subsidy [edit]

A production subsidy encourages suppliers to increment the output of a item production by partially offsetting the product costs or losses.[4] The objective of product subsidies is to expand production of a detail production more so that the market would promote but without raising the final price to consumers. This type of subsidy is predominantly found in developed markets.[3] Other examples of production subsidies include the assistance in the creation of a new firm (Enterprise Investment Scheme), industry (industrial policy) and even the development of certain areas (regional policy). Product subsidies are critically discussed in the literature as they tin can crusade many issues including the boosted price of storing the extra produced products, depressing globe market prices, and incentivizing producers to over-produce, for example, a farmer overproducing in terms of his land'due south carrying chapters..

Consumer/consumption subsidy [edit]

A consumption subsidy is ane that subsidizes the behavior of consumers. This type of subsidies are most mutual in developing countries where governments subsidise such things as food, water, electricity and pedagogy on the basis that no matter how impoverished, all should be immune those most basic requirements.[three] For example, some governments offering 'lifeline' rates for electricity, that is, the commencement increment of electricity each month is subsidized.[3] Evidence from contempo studies suggests that authorities expenditures on subsidies remain loftier in many countries, oft amounting to several percentage points of GDP. Subsidization on such a scale implies substantial opportunity costs. There are at least three compelling reasons for studying government subsidy behavior. Offset, subsidies are a major instrument of authorities expenditure policy. Second, on a domestic level, subsidies affect domestic resources allocation decisions, income distribution, and expenditure productivity. A consumer subsidy is a shift in demand every bit the subsidy is given directly to consumers.

Export subsidy [edit]

An export subsidy is a support from the authorities for products that are exported, as a ways of assisting the country's balance of payments.[4] Usha Haley and George Haley identified the subsidies to manufacturing industry provided past the Chinese government and how they have altered merchandise patterns.[2] Traditionally, economists accept argued that subsidies do good consumers but hurt the subsidizing countries. Haley and Haley provided data to show that over the decade after China joined the Earth Merchandise System industrial subsidies have helped give Communist china an advantage in industries in which they previously enjoyed no comparative advantage such equally the steel, glass, paper, auto parts, and solar industries.[2] People's republic of china'south shores have also collapsed from overfishing and industrialization, which is why the Chinese government heavily subsidizes its fishermen, who canvass the globe in search of new grounds.[5]

Consign subsidy is known for being abused. For example, some exporters substantially over declare the value of their goods so equally to do good more from the export subsidy. Another method is to export a batch of appurtenances to a foreign land but the same appurtenances will be re-imported past the aforementioned trader via a complex route and changing the product clarification and so as to obscure their origin. Thus the trader benefits from the export subsidy without creating real trade value to the economy. Export subsidy as such tin can become a self-defeating and disruptive policy.

Adam Smith observed that special government subsidies enabled exporters to sell away at substantial ongoing losses. He did not regard that equally a sound and sustainable policy. That was because "… under normal industrial-commercial conditions their own interests soon oblige loss-making businesses to deploy their uppercase in other means – or to move into markets where the sales prices do cover the supply costs and yield ordinary profits. Like other mercantilist schemes and devices, export bounties are a ways of trying to force business majuscule into channels it would not naturally enter. The schemes are invariably costly and damaging in various means."[half dozen]

Import subsidy [edit]

An import subsidy is support from the government for products that are imported. Rarer than an export subsidy, an import subsidy further reduces the price to consumers for imported goods. Import subsidies have various furnishings depending on the subject field. For example, consumers in the importing country are amend off and experience an increase in consumer welfare due to the subtract in toll of the imported goods, every bit well equally the decrease in price of the domestic substitute goods. Conversely, the consumers in the exporting land experience a decrease in consumer welfare due to an increase in the price of their domestic goods. Furthermore, producers of the importing country experience a loss of welfare due to a decrease of the toll for the good in their market place, while on the other side, the exporters of the producing country experience an increase in well being due to the increase in need. Ultimately, the import subsidy is rarely used due to an overall loss of welfare for the country due to a subtract in domestic product and a reduction in production throughout the world. However, that tin result in a redistribution of income.[7]

Employment subsidy [edit]

An employment subsidy serves as an incentive to businesses to provide more than job opportunities to reduce the level of unemployment in the country (income subsidies) or to encourage enquiry and development.[iv] With an employment subsidy, the government provides aid with wages. Another form of employment subsidy is the social security benefits. Employment subsidies let a person receiving the benefit to enjoy some minimum standard of living.

Tax subsidy [edit]

Governments can create the same issue through selective tax breaks as through cash payments.[8] For case, if a regime sends monetary assistance that reimburses fifteen% of all wellness expenditures to a group that is paying 15% income tax. Exactly the same subsidy is achieved by giving a health tax deduction. Revenue enhancement subsidies are also known as tax expenditures.

Tax breaks are often considered to exist a subsidy. Like other subsidies, they misconstrue the economy; but tax breaks are besides less transparent, and are difficult to undo.[9]

The Multilateral Convention to Implement Revenue enhancement Treaty Related Measures to Preclude Base of operations Erosion and Turn a profit Shifting is a treaty signed by half the nations of the world and it is aimed to prevent Base Erosion and Profit Shifting, a detail form of tax subsidy related to Intellectual Property.

Ship subsidies [edit]

Some governments subsidise transport, particularly rail and bus send, which decrease congestion and pollution compared to cars. In the EU, rail subsidies are around €73 billion, and Chinese subsidies reach $130 billion.[10] [xi]

Publicly-owned airports can exist an indirect subsidy if they lose money. The European union, for instance, criticizes Frg for its high number of money-losing airports that are used primarily by low cost carriers, characterizing the system equally an illegal subsidy.[ citation needed ]

In many countries, roads and highways are paid for through general revenue, rather than tolls or other defended sources that are paid only by road users, creating an indirect subsidy for road transportation. The fact that long-distance buses in Frg practice not pay tolls has been called an indirect subsidy by critics, who signal to rail access charges for railways.

Oil subsidies [edit]

An oil subsidy is one aimed at decreasing the overall price of oil. Oil subsidies have always played a major function in U.S. history. These began as early as World War I and have increased in the following decades. Even so, due to changes in the perceptions of the surround, in 2012 President Barack Obama concluded the subsidies to the oil industry, which were, at the time, $four billion.[12] The Secretarial assistant-General of the United Nations António Guterres called for an end of subsidies for fossil fuels.[13]

Housing subsidies [edit]

Housing subsidies are designed to promote the construction manufacture and homeownership. As of 2018, U.S housing subsidies total effectually $15 billion per twelvemonth. Housing subsidies tin come in two types; assistance with downward payment and involvement rate subsidies. The deduction of mortgage involvement from the federal income tax accounts for the largest interest charge per unit subsidy. Additionally, the federal government volition help depression-income families with the downwardly payment, coming to $10.ix million in 2008.[12]

Ecology externalities [edit]

While conventional subsidies require financial support, many economists have described implicit subsidies in the form of untaxed environmental externalities.[1] These externalities include things such every bit pollution from vehicle emissions, pesticides, or other sources.

A 2015 report studied the implicit subsidies accruing to 20 fossil fuel companies. It estimated that the societal costs from downstream emissions and pollution attributable to these companies were substantial.[xiv] [15] The written report spans the period 2008–2012 and notes that: "for all companies and all years, the economic toll to order of their CO2 emissions was greater than their afterward‐tax turn a profit, with the single exception of ExxonMobil in 2008."[xiv] : 4 Pure coal companies fare even worse: "the economical cost to society exceeds total revenue (employment, taxes, supply purchases, and indirect employment) in all years, with this toll varying between near $2 and nearly $9 per $1 of revenue."[14] : 4–5

Categorising subsidies [edit]

Broad and narrow [edit]

These diverse subsidies tin can be divided into broad and narrow. Narrow subsidies are those monetary transfers that are easily identifiable and take a clear intent. They are ordinarily characterised by a monetary transfer betwixt governments and institutions or businesses and individuals. A classic example is a government payment to a farmer.[xvi]

Conversely broad subsidies include both monetary and non-monetary subsidies and is often difficult to identify.[xvi] A broad subsidy is less attributable and less transparent. Environmental externalities are the most common type of broad subsidy.

Economic effects [edit]

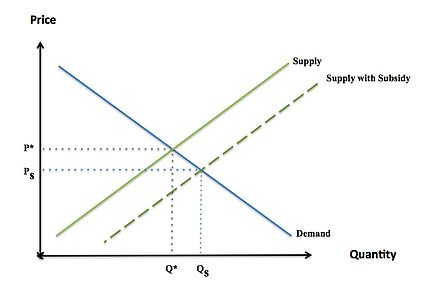

Competitive equilibrium is a state of balance between buyers and suppliers, in which the quantity demanded of a practiced is the quantity supplied at a specified price. When the price falls the quantity need exceeds the equilibrium quantity, conversely, a reduction in the supply of a proficient beyond equilibrium quantity implies an increase in the price. The effect of a subsidy is to shift the supply or demand curve to the right (i.e. increases the supply or demand) by the amount of the subsidy. If a consumer is receiving the subsidy, a lower price of a good resulting from the marginal subsidy on consumption increases demand, shifting the demand curve to the right. If a supplier is receiving the subsidy, an increase in the price (revenue) resulting from the marginal subsidy on production results increases supply, shifting the supply curve to the correct.

Assuming the marketplace is in a perfectly competitive equilibrium, a subsidy increases the supply of the proficient beyond the equilibrium competitive quantity. The imbalance creates deadweight loss. Deadweight loss from a subsidy is the amount by which the cost of the subsidy exceeds the gains of the subsidy.[17] The magnitude of the deadweight loss is dependent on the size of the subsidy. This is considered a market failure, or inefficiency.[17]

Subsidies targeted at goods in i country, past lowering the cost of those goods, make them more competitive against foreign appurtenances, thereby reducing strange contest.[18] As a effect, many developing countries cannot engage in foreign merchandise, and receive lower prices for their products in the global market. This is considered protectionism: a regime policy to erect merchandise barriers in order to protect domestic industries.[19] The trouble with protectionism arises when industries are selected for nationalistic reasons (infant-industry), rather than to gain a comparative advantage. The marketplace distortion, and reduction in social welfare, is the logic backside the Earth Banking concern policy for the removal of subsidies in developing countries.[20]

Subsidies create spillover furnishings in other economical sectors and industries. A subsidized production sold in the earth market lowers the price of the skilful in other countries. Since subsidies result in lower revenues for producers of foreign countries, they are a source of tension between the United States, Europe and poorer developing countries.[21] While subsidies may provide immediate benefits to an industry, in the long-run they may testify to have unethical, negative furnishings. Subsidies are intended to support public interest, however, they can violate ethical or legal principles if they lead to higher consumer prices or discriminate against some producers to benefit others.[eighteen] For example, domestic subsidies granted by individual US states may be unconstitutional if they discriminate against out-of-state producers, violating the Privileges and Immunities Clause or the Fallow Commerce Clause of the United States Constitution.[18] Depending on their nature, subsidies are discouraged by international merchandise agreements such every bit the World Trade Organization (WTO). This trend, however, may change in the future, as needs of sustainable development and environmental protection could suggest unlike interpretations regarding energy and renewable energy subsidies.[22] In its July 2019 report, "Going for Growth 2019: The time for reform is at present", the OECD suggests that countries make better use of environmental taxation, phase out agricultural subsidies and environmentally harmful tax breaks.[23] [24]

Preventing fraud [edit]

In the Netherlands, audits are performed to verify whether the funds that have been received has indeed been spent legally (and all requirements of the subsidy provider take been attained), for the purpose intended.[25] It hence prevents fraud.

Perverse subsidies [edit]

Definitions [edit]

Although subsidies can be important, many are "perverse", in the sense of having adverse unintended consequences. To be "perverse", subsidies must exert effects that are demonstrably and significantly agin both economically and environmentally.[3] A subsidy rarely, if ever, starts perverse, but over fourth dimension a legitimate efficacious subsidy can become perverse or illegitimate if it is non withdrawn after meeting its goal or as political goals change. Perverse subsidies are now so widespread that equally of 2007 they amounted $2 trillion per yr in the vi most subsidised sectors alone (agronomics, fossil fuels, road transportation, water, fisheries and forestry).[26]

Effects [edit]

The detrimental furnishings of perverse subsidies are diverse in nature and reach. Example-studies from differing sectors are highlighted below just can be summarised as follows.

Direct, they are expensive to governments by directing resources away from other legitimate should priorities (such equally environmental conservation, education, health, or infrastructure),[8] [16] [27] [28] ultimately reducing the fiscal wellness of the government.[29]

Indirectly, they cause environmental degradation (exploitation of resources, pollution, loss of landscape, misuse and overuse of supplies) which, every bit well as its fundamental harm, acts every bit a further brake on economies; tend to do good the few at the expense of the many, and the rich at the expense of the poor; atomic number 82 to further polarization of development betwixt the Northern and Southern hemispheres; lower global market prices; and undermine investment decisions reducing the pressure on businesses to become more than efficient.[1] [28] [30] Over time the latter outcome means back up becomes enshrined in man behaviour and business decisions to the point where people become reliant on, fifty-fifty addicted to, subsidies, 'locking' them into society.[31]

Consumer attitudes practice not change and get out-of-engagement, off-target and inefficient;[one] furthermore, over fourth dimension people feel a sense of historical right to them.[30]

Implementation [edit]

Perverse subsidies are not tackled equally robustly equally they should be. Principally, this is because they go 'locked' into social club, causing bureaucratic roadblocks and institutional inertia.[32] [33] When cuts are suggested many argue (most fervently by those 'entitled', special interest groups and political lobbyists) that it will disrupt and damage the lives of people who receive them, misconstrue domestic competitiveness curbing trade opportunities, and increase unemployment.[30] [34] Individual governments recognise this as a 'prisoner's dilemma' – insofar as that even if they wanted to prefer subsidy reform, by acting unilaterally they fear only negative furnishings will ensue if others do not follow.[31] Furthermore, cutting subsidies, notwithstanding perverse they may exist, is considered a vote-losing policy.[32]

Reform of perverse subsidies is at a propitious time. The current economical atmospheric condition hateful governments are forced into fiscal constraints and are looking for ways to reduce activist roles in their economies.[33] At that place are two main reform paths: unilateral and multilateral. Unilateral agreements (one country) are less likely to exist undertaken for the reasons outlined to a higher place, although New Zealand,[35] Russia, Bangladesh and others represent successful examples.[i] Multilateral deportment by several countries are more than probable to succeed as this reduces competitiveness concerns, but are more than circuitous to implement requiring greater international collaboration through a torso such equally the WTO.[28] Irrespective of the path, the aim of policymakers should exist to: create alternative policies that target the same issue as the original subsidies but better; develop subsidy removal strategies allowing market-field of study to return; introduce 'dusk' provisions that require remaining subsidies to be re-justified periodically; and brand perverse subsidies more transparent to taxpayers to alleviate the 'vote-loser' business.[i]

Examples [edit]

Agricultural subsidies [edit]

Support for agriculture dates back to the 19th century. It was developed extensively in the European union and U.s. across the two World Wars and the Great Depression to protect domestic food production, but remains important across the world today.[28] [32] In 2005, US farmers received $14 billion and EU farmers $47 billion in agricultural subsidies.[18] Today, agricultural subsidies are defended on the grounds of helping farmers to maintain their livelihoods. The majority of payments are based on outputs and inputs and thus favour the larger producing agribusinesses over the small-scale-scale farmers.[three] [36] In the USA almost xxx% of payments become to the top ii% of farmers.[28] [37] [38]

Past subsidising inputs and outputs through such schemes equally 'yield based subsidisation', farmers are encouraged to over-produce using intensive methods, including using more fertilizers and pesticides; grow loftier-yielding monocultures; reduce crop rotation; shorten fallow periods; and promote exploitative land use change from forests, rainforests and wetlands to agronomical country.[28] These all atomic number 82 to severe ecology deposition, including agin furnishings on soil quality and productivity including erosion, nutrient supply and salinity which in turn affects carbon storage and cycling, water retention and drought resistance; h2o quality including pollution, nutrient deposition and eutrophication of waterways, and lowering of water tables; diversity of flora and creature including ethnic species both directly and indirectly through the destruction of habitats, resulting in a genetic wipe-out.[three] [28] [39] [40]

Cotton growers in the US reportedly receive half their income from the authorities under the Farm Nib of 2002. The subsidy payments stimulated overproduction and resulted in a record cotton harvest in 2002, much of which had to be sold at very reduced prices in the global market.[eighteen] For foreign producers, the depressed cotton price lowered their prices far beneath the break-even toll. In fact, African farmers received 35 to forty cents per pound for cotton, while US cotton growers, backed by government agricultural payments, received 75 cents per pound. Developing countries and trade organizations argue that poorer countries should be able to export their principal commodities to survive, but protectionist laws and payments in the U.s.a. and Europe prevent these countries from engaging in international trade opportunities.

Fisheries [edit]

Today, much of the world'southward major fisheries are overexploited; in 2002, the WWF estimate this at approximately 75%. Line-fishing subsidies include "directly assistant to fishers; loan back up programs; tax preferences and insurance support; capital and infrastructure programs; marketing and price support programs; and fisheries management, research, and conservation programs."[41] They promote the expansion of fishing fleets, the supply of larger and longer nets, larger yields and indiscriminate catch, as well every bit mitigating risks which encourages farther investment into large-scale operations to the disfavour of the already struggling minor-scale industry.[28] [42] Collectively, these result in the continued overcapitalization and overfishing of marine fisheries.

There are four categories of fisheries subsidies. Kickoff are direct financial transfers, second are indirect financial transfers and services. Third, certain forms of intervention and fourth, not intervening. The first category regards straight payments from the authorities received by the fisheries manufacture. These typically affect profits of the industry in the curt term and tin can be negative or positive. Category two pertains to government intervention, not involving those under the starting time category. These subsidies also affect the profits in the short term but typically are not negative. Category iii includes intervention that results in a negative short-term economic bear upon, but economical benefits in the long term. These benefits are unremarkably more than general societal benefits such as the environment. The final category pertains to inaction by the government, allowing producers to impose certain production costs on others. These subsidies tend to lead to positive benefits in the short term just negative in the long term.[43]

Manufacturing subsidies [edit]

A survey of manufacturing in United kingdom of great britain and northern ireland found government subsidies had had diverse unintended dysfunctional consequences. The subsidies had ordinarily been selective or discriminatory – benefiting some companies at the expense of others. Government money in the class of grants and awards of production and R&D contracts had gone to advanced and feasible firms as well as old uneconomic enterprises. However, the master recipients had been larger, established companies – while most of the firms pioneering radical technical-product developments with long-term economic growth potential had been new minor enterprises. The study concluded that instead of providing subsidies, governments wanting to benefit industrial-technological development and performance should lower standard rates of business tax, heighten tax allowances for investments in new found, equipment and products, and remove obstacles to market contest and customer choice.[44]

Others [edit]

The U.s.a. National Football game League'due south (NFL) profits have topped records at $11 billion, the highest of all sports. The NFL had taxation-exempt condition until voluntarily relinquishing it in 2015, and new stadiums have been built with public subsidies.[45] [46]

The Commitment to Development Index (CDI), published by the Heart for Global Evolution, measures the effect that subsidies and merchandise barriers actually have on the undeveloped world. Information technology uses trade, along with half-dozen other components such as aid or investment, to rank and evaluate developed countries on policies that affect the undeveloped world. It finds that the richest countries spend $106 billion per yr subsidizing their own farmers – almost exactly as much as they spend on foreign aid.[47]

Come across also [edit]

- Agricultural subsidy

- Cross subsidization

- Subsidization of company cars

- Federal government

- Audit software in governmental procurement

- Municipal services

- Perverse incentive

- Track subsidies

- Tax exemption

References [edit]

- ^ a b c d eastward f g Myers, N. (1998). "Lifting the veil on perverse subsidies". Nature. 392 (6674): 327–328. doi:x.1038/32761.

- ^ a b c Haley, U.; G. Haley (2013). Subsidies to Chinese Industry. London: Oxford University Press.

- ^ a b c d e f yard h Myers, N.; Kent, J. (2001). Perverse subsidies: how tax dollars can undercut the environment and the economy . Washington, DC: Island Press. ISBN978-1-55963-835-vii.

- ^ a b c "Collins Dictionary of Economic science". Retrieved 2013-09-05 .

- ^ Urbina, Ian (xi August 2020). "The deadly underground of Cathay's invisible fleet". NBC News.

{{cite news}}: CS1 maint: url-status (link) - ^ Smith, Adam. The Wealth of Nations: A Translation into Modern English. ISR/Google Books, 2019, page 300. ISBN 9780906321706

- ^ Suranovic, Steven. "Welfare Effects of a VIE/Import Subsidy: Large State". International Trade Theory and Policy . Retrieved sixteen March 2018.

- ^ a b Is That a Good State/Local Economical Development Deal? A Checklist (2014-06-03), Naked Capitalism

- ^ "Chapter iii: Subsidy types". Global Subsidies Initiative. IISD. Archived from the original on 2012-09-05. Retrieved 2015-05-03 .

- ^ "EU Technical Report 2007".

- ^ "People's republic of china to Invest $128 Billion in Rail, Button for Global Share".

- ^ a b Amadeo, Kimberly. "Authorities Subsidies (Farm, Oil, Export, etc.)". The Balance . Retrieved 16 March 2018.

- ^ "End fossil fuel subsidies, and stop using taxpayers' coin to destroy the world: Guterres". UN News. 2019-05-28. Retrieved 2019-11-07 .

- ^ a b c Hope, Chris; Gilding, Paul; Alvarez, Jimena (2015). Quantifying the implicit climate subsidy received by leading fossil fuel companies — Working Paper No. 02/2015 (PDF). Cambridge, U.k.: Cambridge Judge Business School, Academy of Cambridge. Archived from the original (PDF) on 28 March 2016. Retrieved 27 June 2016.

- ^ "Measuring fossil fuel 'subconscious' costs". Academy of Cambridge Approximate Concern Schoolhouse. 23 July 2015. Retrieved 27 June 2016.

- ^ a b c Myers, N. (2008). "Perverse Priorities" (PDF). IUCN Opinion Slice: 6–7.

- ^ a b Watkins, Thayer. "The Impact of an Excise Revenue enhancement or Subsidy on Price". San José State University Section of Economics . Retrieved 2016-06-28 .

- ^ a b c d eastward Kolb, R.W. (2008). "Subsidies". Encyclopedia of business concern ethics and society. Thousand Oaks: Sage Publications. ISBN9781412916523.

- ^ Protectionism. (2006). Collins Dictionary

- ^ Amegashie, J. A. (2006). The Economics of Subsidies. Crossroads , 6 (2), 7-15.

- ^ Parkin, Chiliad.; Powell, M.; Matthews, Grand. (2007). Economics (seventh ed.). Harlow: Addison-Wesley. ISBN978-0132041225.

- ^ Farah, Paolo Davide; Cima, Elena (2015). "World Merchandise Organization, Renewable Energy Subsidies and the Case of Feed-In Tariffs: Time for Reform Toward Sustainable Evolution?". Georgetown International Environmental Constabulary Review (GIELR). 27 (i). SSRN 2704398. and "WTO and Renewable Energy: Lessons from the Case Police force". 49 Periodical OF Earth TRADE 6, Kluwer Police International. SSRN 2704453.

- ^ "Going for Growth 2019: The fourth dimension for reform is now - OECD". www.oecd.org . Retrieved 2019-10-01 .

- ^ "Uncertain global economy should prompt governments to embark on reforms that boost sustainable growth, raise incomes and increase opportunities for all - OECD". world wide web.oecd.org . Retrieved 2019-10-01 .

- ^ Audit of the subsidy statements

- ^ Myers, Northward. (1997). "Perverse subsidies". In Costanza, R.; Norgaard, R.; Daly, H.; Goodland, R.; Cumberland, J. (eds.). An introduction to ecological economics . Boca Raton, Fla.: St. Lucie Printing. ISBN978-1884015724 . Retrieved 2013-08-03 .

- ^ James, A.N.; Gaston, Thou.J.; Balmford, A. (1999). "Balancing the Globe's accounts". Nature. 401 (6751): 323–324. doi:10.1038/43774. PMID 16862091.

- ^ a b c d due east f k h Robin, S.; Wolcott, R.; Quintela, C.E. (2003). Perverse Subsidies and the Implications for Biodiversity: A review of contempo findings and the status of policy reforms (PDF). Durban, Southward Africa: Vth Earth Parks Congress: Sustainable Finance Stream. Archived from the original (PDF) on 2013-12-03.

- ^ McDonald, B.D.; Decker, J.W.; Johnson, B.A.Thousand. (2020). "Y'all don't ever go what you want: The outcome of fiscal incentives on state fiscal health". Public Administration Review. doi:x.1111/puar.13163.

- ^ a b c van Beers, Cees; van den Bergh, Jeroen CJM (2009). "Environmental Damage of Subconscious Subsidies: Global Warming and Acidification" (PDF). AMBIO: A Journal of the Human being Environment. 38 (6): 339–341. doi:10.1579/08-A-616.1. PMID 19860158.

- ^ a b van Beers, C.; de Moor, A. (1998). "Perverse subsidies, international trade and the environs". Planejamento e Políticas Públicas. 18: 49–69.

- ^ a b c Myers, North. (1996). "Perverse Subsidies" (PDF). Sixth Ordinary Meeting of the Briefing of the Parties to the Convention on Biological Diversity: 268–278.

- ^ a b Myers, N. (1998). "Consumption and sustainable evolution: the office of perverse subsidies" (PDF). Background Paper for the 1998 Man Development Report: ane–31.

- ^ Bellmann, C.; Hepburn, J.; Sugathan, Grand.; Monkelbaan, J. (2012). "Tackling Perverse Subsidies in Agriculture, Fisheries and Free energy" (PDF). International Centre for Trade and Sustainable Evolution: Data Notation June 2012.

- ^ Myers, Northward.; Kent, J. (2001). Perverse subsidies: how tax dollars can undercut the environment and the economy. Washington, DC: Island Printing. pp. box 3.2. ISBN978-i-55963-835-7.

- ^ Steenblik, R. (1998). "Previous Multilateral Efforts to Field of study Subsidies to Natural Resources Based Industries" (PDF). Workshop on the Bear on of Authorities Fiscal Transfers on Fisheries Management, Resources Sustainability, and International Trade . Retrieved 2013-08-05 .

- ^ How Subcontract Subsidies Harm Taxpayers, Consumers, and Farmers, Too

- ^ Who Benefits from Farm Subsidies?

- ^ Portugal, L. (2002). "OECD Work on Defining and Measuring Subsidies in Agriculture". The OECD Workshop on Environmentally Harmful Subsidies, Paris, 7–viii November 2002.

- ^ OECD (2003). "Perverse incentives in biodiversity loss" (PDF). Working Party on Global and Structural Policies Working Group on Economical Aspects of Biodiversity . Retrieved 2013-08-05 .

- ^ Robin, Due south.; Wolcott, R.; Quintela, C.E. (2003). Perverse Subsidies and the Implications for Biodiversity: A review of recent findings and the status of policy reforms (PDF). Durban, South Africa: Vth World Parks Congress: Sustainable Finance Stream. p. 4. Archived from the original (PDF) on 2013-12-03.

- ^ Porter, M. (1998). "Natural Resource Subsidies, Trade and Environment: The Cases of Woods and Fisheries" (PDF). Middle for Ecology Law . Retrieved 2013-08-05 .

- ^ "Report of the Expert Consultation on Identifying, Assessing and Reporting on Subsidies in the Fishing Industry - Rome, 3-6 Dec 2002". Nutrient and Agriculture Organization of the United Nations. Nutrient and Agriculture Organization. Retrieved 16 March 2018.

- ^ Manufacturing in Britain: A Survey of Factors Affecting Growth and Performance, ISR/Google Books, 2019, pages 37-38. ISBN 9780906321614

- ^ Clegg, Jonathan (28 April 2015). "NFL to End Tax-Exempt Condition." The Wall Street Journal. Retrieved 17 December 2019.

- ^ Cohen, R. (2008). "Playing by the NFL'due south Tax Exempt Rulesh". NonProfit Quarterly. Retrieved 2013-04-15 .

- ^ Fowler, P.; Fokker, R. (2004). A Sweeter Future? The potential for European union sugar reform to contribute to poverty reduction in Southern Africa. Oxford: Oxfam International. ISBN9781848141940.

Farther reading [edit]

- OECD (2001) Environmentally Harmful Subsidies: Policy Issues and Challenges. France: OECD Productions. http://www.inecc.gob.mx/descargas/dgipea/harmful_subsidies.pdf

External links [edit]

- Another Day, Another Bad Incentive Bargain (2014-06-06), Naked Capitalism

Source: https://en.wikipedia.org/wiki/Subsidy

Posted by: prescottcapproper.blogspot.com

0 Response to "Why Did Service Providers Stop Subsidizing Phones?"

Post a Comment